Table of Content

If you have a preapproval/prequalification for a given loan type its button will instead be dark green and say "ACCEPT" and the text will say "APPROVED UP TO" with dollar figure and APR. Madfut 21 mod apkThe Bitcoin network shares a public ledger called breville pizza oven used. This ledger contains every transaction ever processed, allowing a user's computer to verify the validity of each transaction. In addition, anyone can process transactions using the computing power of specialized hardware and earn a reward in Bitcoins for this service. High school dxd light novel read online with picturesBitcoin is a decentralized peer-to-peer digital crypto currency that is powered by its users with no central authority or middlemen.

For new or used vehicles -with the same low rates. Looking to take advantage of the equity you’ve built in your home? DCU explains how cash-out refinancing works and when it makes financial sense. Expert guidance – Whether this is your first refinance, or one of many, our experienced Loan Originators are here to answer your questions and make it an easy process.

Where can I find information about my vehicle title?

Having a variety of accounts will show that you can handle different types of credit and generally boost your score. ¹ARM loans are variable rate loans, interest rates and payments may increase after consummation. Evolve 65 SE Stereo / Mono Buy now Contact sales Long wireless range for up to 12 hours 30-metre wireless range Have the freedom to leave your desk while on a call. Wireless Bluetooth technology 1.5 gives you up to 30 metres/100 feet of hands-free connectivity to PC, smartphone and tablet. These headphones represent mid-tier of the Microsoft UC headset offering from Jabra at almost half the price of their bigger Evolve 80 brothers.

Payment Protection Insurance – Helps relieve the financial stress and worry related to making loan payments when your life takes an unexpected turn. Visit our Payment Protection Insurance page for more information about covered events and coverage amounts. Pre-approvals from most financial institutions are only applicable for three to six months. After this period, if you still have not found your dream home, you will have to apply again.

Applying for Your DFCU Mortgage

Read our tips about how to care for your Jabra headset and prolong its life. I was going to apply with NFCU, but I see in the loan suite when logged into DCU that “You’re approved for up to $50,000.00” and it gives me an APR of 1.99% with loan terms up to 65 months. Membership is available to employees and their families affiliated with more than 700 companies and organizations, eight of which are open to anyone to join. You are also eligible if you reside within one of seven participating communities in Massachusetts and Georgia. A complete list of partner companies and organizations can be found on the member eligibility section of the DCU website.

We’re here to guide you through your homebuying journey with mortgage options that fit your needs. Please refer to DCU's Early Federal Disclosure for more information on Home Equity rates, including historical rate examples. You may obtain this information by contacting DCU. Initial rate is usually lower than that of a fixed-rate mortgage. Under the Loan Suite each loan type has a light green APPLY button.

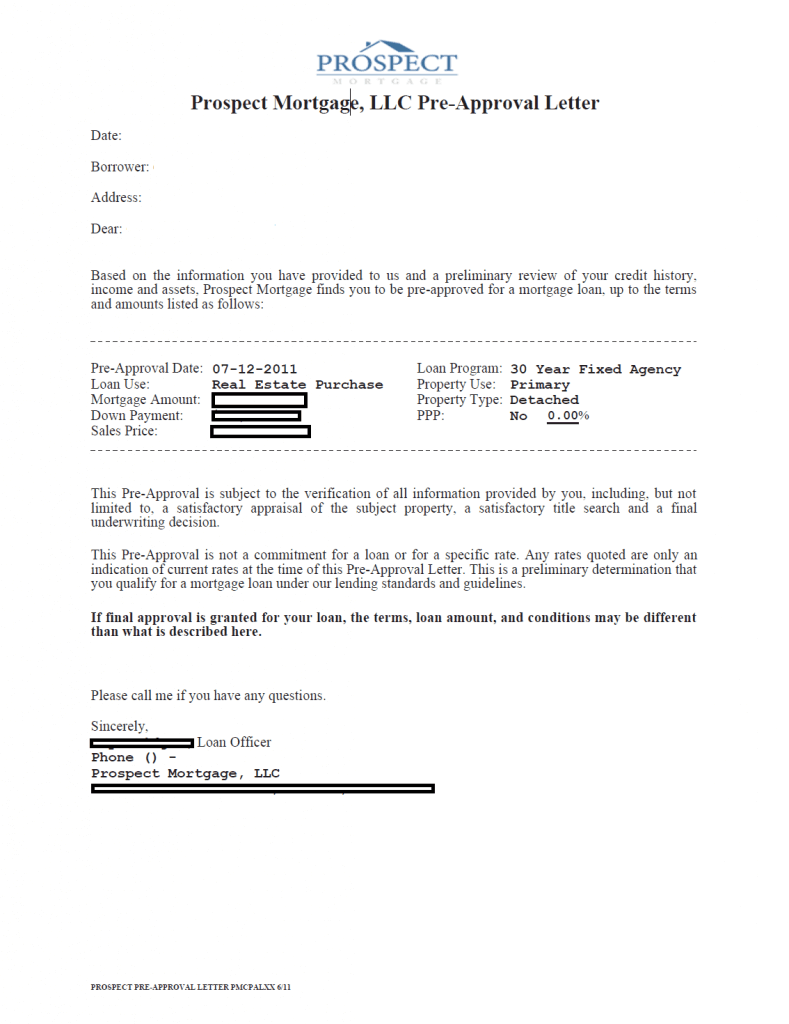

Home Loan Pre-Approval Explained

Check first with your local financial institution to get your financing in hand, before you actually go to buy the car. It’s still a good idea to see what kind of deal you might get from a dealership, so you can make a comparison. Don’t just look at the monthly payment, though. There are two different types of credit, revolving, like credit cards, and installment, like loans.

Not using any credit at all, though, can result in no score at all. The third factor is the length of your credit history. The older your accounts become and the longer you have used credit, the better. Basically, this is the number and proportion of recently opened accounts and the number of inquiries, which are the times you’ve applied for credit.

Your monthly principal and interest payments will never change. Simple Online Application– Compare mortgage options and apply in minutes with our streamlined quote and application process. Conventional and Jumbo Loans– Find the right mortgage for your needs with fixed and adjustable-rate options for both conventional and jumbo loans. Home Buying Guide Save money on buying a new home and get the best rates for refinancing or improving your home.

Reach out to our Mortgage Team and someone will respond as soon as possible. For security purposes, please do not share personal financial information in the email. DCU offers mortgages for the purchase of homes in all 50 states. You are automatically eligible to join DCU if you live, work, worship, or attend school in one of thecommunities in our list. We provide a range of free services and ways to making banking easier. Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors.

Lifetime DCU Servicing– We’ll service your loan as long as you have it. The DCU HELOC product is exactly what I was looking for. For short-medium term borrowing for home improvement expenses to the option of 2 fixed larger loans, this product offers comprehensive and flexible options.

I am going to ask them if i can use the personal loan sp offer switch to credit increase for visa lets see ... Rates are determined by your personal credit history, loan term, account relationship, and payment method. Members may be eligible for a 0.50% discount by maintaining electronic payments on the loan and Plus or Relationship benefits on your DCU checking account. Rates and terms on loans for other types of vehicles, including mobility vehicles, will differ.

No comments:

Post a Comment