Table of Content

At DCU, prequalification is the initial step to applying for a mortgage for home purchase. I was wondering if DCU has released their pre approvals for April yet. Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate. In all other areas of the country, members will need to use online and mobile banking, or access a co-op shared branch at another credit union. While the DFCU Financial Board of Directors intends to pay Cash Back every year, and has done so since 2007, Cash Back is not guaranteed and will depend on our financial performance and other factors. Annual Cash Back payments are limited to an aggregate of $25,000 for each tax-reported owner.

For Purchases, you may lock your interest rate within 60 days of your closing date. For all loan types, the rate must be locked at least 14 days prior to closing. If the rates go down, the interest rate effective for your rate lock still applies. If your rate lock expires, and the market rates increase, your loan will be based on the new prevailing rates. A Fixed Rate Mortgage is a loan with a set interest rate and equal monthly principal and interest payments for the entire term of the loan.

Best rates and service

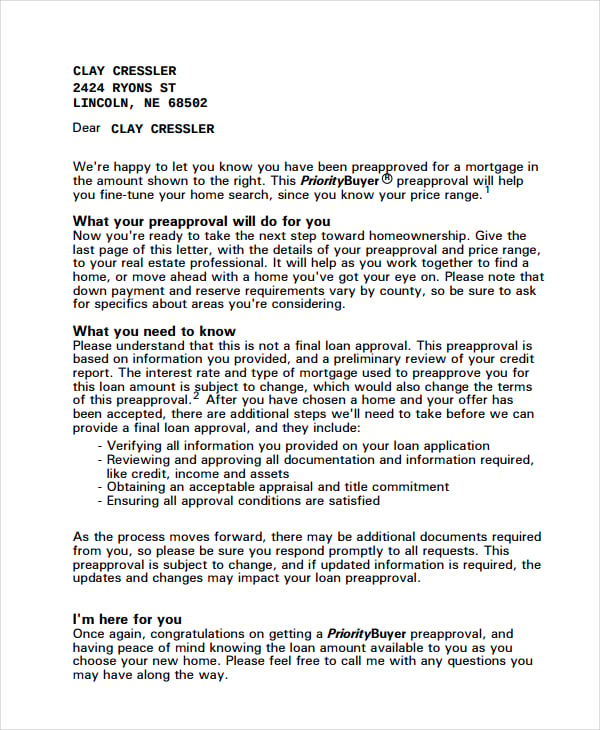

Many people are concerned about applying for credit and it lowering the score. Prequalifications and preapprovals are two ways to verify if a potential borrower can afford a mortgage. Borrowers apply for prequalification while they are searching for a home. Prequalification allows you and sellers to estimate how much you can afford.

I strongly recommend DCU for all your banking. Many factors go into determining the final loan amount for the purchase of a new or used vehicle. These factors include any manufacturer's rebate, the trade-in value of your old vehicle less any outstanding balance, your down payment, etc. The timeline for application and funding can vary, depending on how quickly the required documentation is provided.

Mortgage

Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks. This includes bluetooth pairing guide, FAQs, documents, videos, firmware, software and apps for your product.. If all or part of your PPP loan is not forgiven, your first loan payment will be due the first of the following month after a decision is made by the SBA. RCU is automatically calculating your loan due date based on a 24-week covered period, if you intend on using a shorter covered period please inform us immediately as this will impact your due date.

When you do find a home that you love in your price range, you have the peace of mind to proceed to auction or make an offer. Pre-approval, sometimes referred to as conditional approval or approval in principle, is an indication from your lender of how much you may be able to borrow. You do not have to have found the house you intend to buy. Rather, pre-approval can help you to narrow your search and eventually place an offer with confidence. Relieve the financial stress and worry related to making loan payments. We needed to get preapproved for a car loan, the process took about an hour and was completely seamless.

AUTO LOANS

Ensure you confirm the validity period of your pre-approval with your lender. Large financial commitments, like property, can be both exciting and intimidating – particularly for first home buyers. Luckily, home loan pre-approval may help you to put your best foot forward.

The results shown are based on information and assumptions provided by you regarding your goals, expectations and financial situation. Applicability or accuracy in regards to your individual circumstances is not guaranteed. All examples are hypothetical for illustrative purposes only and are not intended to purport actual user-defined parameters.

Let us help you save money on your next loan.

For new or used vehicles -with the same low rates. Looking to take advantage of the equity you’ve built in your home? DCU explains how cash-out refinancing works and when it makes financial sense. Expert guidance – Whether this is your first refinance, or one of many, our experienced Loan Originators are here to answer your questions and make it an easy process.

Purchase or refinance -borrow to buy your next vehicle or refinance the one you drive. Plan on up to 60 days to close on your new mortgage. Keep in mind that things like your appraisal or a delay in providing necessary documentation may slow down the process. Choose from our easy to use calculators to plan for your mortgage refinance. Lock in a low interest rate for the length of the loan. Schedule a phone appointment with a Mortgage Loan Originator.

She has previously written for Crypto News Australia and was employed as a content writer at Monzi Personal Loans. Based in Brisbane, her goal is to make the financial world easily comprehensible, particularly for the younger generations. The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. Some programs may give you instant online approval.

Having a variety of accounts will show that you can handle different types of credit and generally boost your score. ¹ARM loans are variable rate loans, interest rates and payments may increase after consummation. Evolve 65 SE Stereo / Mono Buy now Contact sales Long wireless range for up to 12 hours 30-metre wireless range Have the freedom to leave your desk while on a call. Wireless Bluetooth technology 1.5 gives you up to 30 metres/100 feet of hands-free connectivity to PC, smartphone and tablet. These headphones represent mid-tier of the Microsoft UC headset offering from Jabra at almost half the price of their bigger Evolve 80 brothers.

Your dream home is still out there, and prequalification can get you one step closer – helping you make a strong offer when you find it. Contact a Mortgage Loan Originator for help completing an application. Frequently asked questions and answers to help manage and plan for your mortgage. You have a family relationship to a non-member who belongs to an organization in our list of participating organizations. Relatives of DCU members are eligible to join if they are spouses, domestic partners, children grandchildren, parents, grandparents or siblings (including adoptive in-law, and step relationships). Helpful resources and tools to assist with your home buying process.

So, let’s break down the ins and outs of home loan pre-approval and the process to obtain one. New and used cars, trucks, and vans at the same low rates. I have been a DCU member with multiple accounts and auto loans for over 6 years now and they are hands down the best out there.

While the actual algorithms are highly complicated, the factors that go into determining your score aren’t. Your FICO score is somewhere between three hundred and eight fifty. A higher score indicates that you are considered a less risky borrower than someone with a lower score. The first and most important component is your payment history. Thirty-five percent of your score is based on how you’ve paid your bills. One of the benefits of financing with DCU is that we will service your loan as long as you have it.

I got no notification, I kept checking on my phone at work today but I was only looking at my inbox for messages. I logged into my account on my computer when I got home, and ... Use this form and provide it to DCU if you are buying a vehicle through a private sale. Count on us for good service and expert help for choosing the best auto insurance. I have been a member of DCU for almost 20 years and I recently applied for my 5th Auto Loan. The process was effortless and the approval was instant.

No comments:

Post a Comment